Forex Trading for Day Traders: Strategies and Techniques

Are you a day trader wanting to delve into Forex trading? Day Trading in Currency Markets can be an intriguing venture with the potential for phenomenal rewards. However, while there are many opportunities to make money with Forex Trading, the lack of experience and knowledge may lead to costly mistakes if not approached appropriately.

As such, it is essential to have various strategies and techniques which will assist one in gaining a better understanding of this dynamic market so that success can be achieved. In this article, we’ll look at some key strategies and techniques which any day trader interested in Forex trading should become familiar with before entering the market.

What is Forex Trading and Why is It A Popular Choice for Day Traders?

Forex trading, or foreign exchange trading, is buying and selling currencies on the global market. It is a popular choice for day traders because of the potential for high return on investment and the ability to trade around the clock. Unlike the stock market, which is open for a set number of hours each day, the forex market is available 24/7, allowing traders to take advantage of fluctuations in the market at any time.

In addition, forex trading offers a high degree of liquidity, meaning that traders can easily buy and sell currencies without impacting the price. With the proper knowledge and strategies, forex trading can be a lucrative venture for day traders looking to make a profit in the fast-paced world of finance. UAE forex trading is prevalent among day traders due to its tax-free status and solid regulatory measures. But no matter where you are, these strategies and techniques can be applied for success.

Top Tips for Building an Effective Trading Strategy

If you’re looking to build an effective trading strategy, you’ll need more than just luck to be successful. The first step is to set clear and specific goals for yourself, whether a certain percentage return or a particular number of trades per week. Once you’ve established your goals, it’s essential to do your research and understand the market conditions you’re working with. It includes keeping up with news and events that may affect the market and analysing trends and patterns in data.

Next, develop a plan based on your research and goals and stick to it. Consistency is vital when it comes to creating your trading strategy. Finally, always learn and adapt to new market conditions. Continuous self-education and flexibility are necessary for success in the ever-changing trading world. By keeping these tips in mind, you’ll be on your way to building an effective trading strategy.

Risk Management Strategies to Help Day Traders Succeed

As with any trading, there is always an element of risk. However, by implementing specific strategies and techniques, day traders can minimise risks and increase their chances of success in the forex market. Some key risk management strategies include setting stop-loss orders to limit potential losses, diversifying your portfolio by trading multiple currency pairs, and practising using a demo account before trading with real money.

In addition, carefully managing leverage and understanding the potential risks can help day traders navigate the market more effectively. It’s also essential to have a well-defined risk management plan and stick to it consistently. Using these strategies, day traders can mitigate risks and increase their overall success rate in forex trading.

Using Technical Indicators to Make Profitable Trades

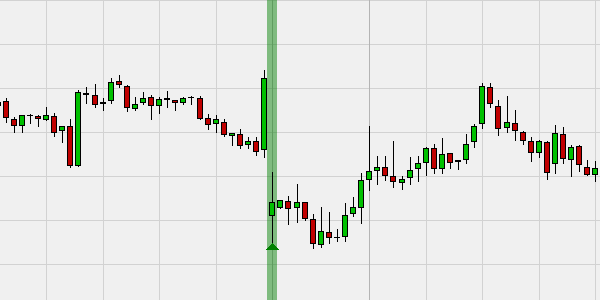

Technical indicators represent market data representations that help traders analyse and predict future price movements. They can be used to determine entry and exit points, as well as track trends in the market. Some common technical indicators day traders use include moving averages, Bollinger bands, and relative strength index (RSI).

While technical indicators can provide valuable insights, using them in conjunction with fundamental analysis and market research is essential. It’s also crucial to regularly update and adjust indicators as market conditions change. Daily traders can make more informed and profitable trading decisions by effectively using technical indicators.

Identifying the Best Opportunities in the Market

One of the critical skills for success in forex trading is the ability to identify and take advantage of the best opportunities in the market. It requires combining technical analysis, fundamental analysis, and market research. Day traders can pinpoint potential opportunities and make informed trades by understanding how different economic factors can impact currency prices.

In addition, it’s essential to stay up-to-date with market news and events and actively monitor charts and data for potential trends. By continuously analysing the market and staying informed, day traders can position themselves to take advantage of the best profit opportunities.

In Conclusion

Forex trading offers a world of opportunity for day traders looking to make their mark in the financial world. With its high liquidity, around-the-clock trading, and potential for high returns, it’s no wonder why so many traders are drawn to this dynamic market. However, success in forex trading requires skill, knowledge, and strategy. By understanding the basics of forex trading, building an effective trading strategy, implementing risk management techniques, using technical indicators effectively, and identifying the best opportunities in the market, day traders can position themselves for success in this exciting and ever-changing market.